在英属维尔京群岛(BVI)注册海外离岸公司的最大的好处是离岸公司可以享有课税极低、甚至乎免税的优惠,有利于企业进行各种财务调度的安排:also,离岸公司更可拥有高度保密性及较少的外汇管制。

由于在该地区投资多数会豁免征收利得税,故一般从事控股、finance、保险及海外基金的公司,都会选择将离岸公司注册于这类税务天堂。而且通过特定的信托安排,信托公司亦可避过缴纳遗产税。

具体

Advantages

体现在以下几个方面:●BVI(英属维尔京群岛)的政治、经济和贸易环境非常稳定;●BVI有良好的金融法律服务机构,方便各种金融机构或基金会的成立与发展;●BVI政府保护股东利益,不需要公布受益人身份;●BVI注册公司不受股东人数限制,一个人可以注册成立有限公司;●BVI政府为各企业提供隐私保护,董事资料绝对保密;●低税率,在该岛注册成立的公司所受的税务管制非常少;●不需会计师的审核报告,只需保留资料反映经济状况即可;●在外地经营所得利润无须交利得税,达到合理避税的目的;●岛上企业在世界各地均可开立银行账户;

About Hong Kong Xintong

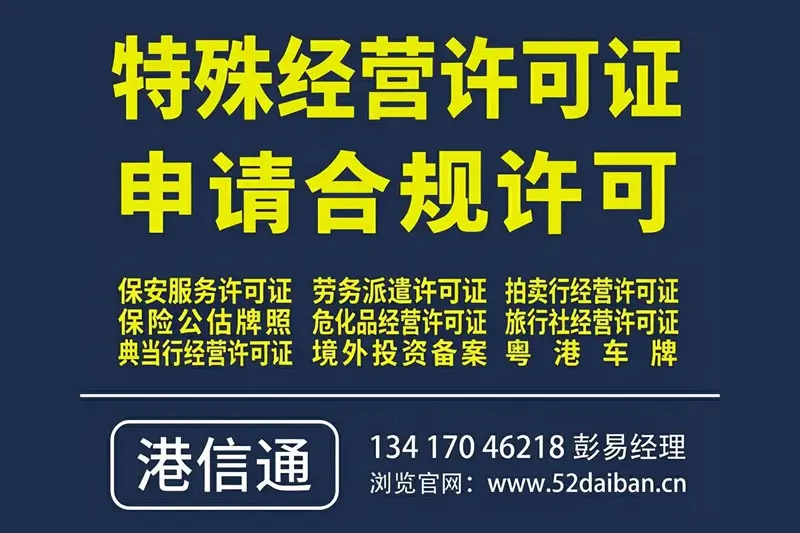

Hong Kong Xintong focuses onGuangdong and Hong Kong license plates、Shenzhen Hazardous Chemicals Business License、Shenzhen labor dispatch licenseandShenzhen Charity Foundationapplication services,Assist customers to applyShenzhen travel agency business license、Shenzhen pawn shop business license、Shenzhen auction house license and other mainstream domestic financial licenses,Support enterprises to achieve compliance expansion of cross-border financial business。Also availableODI overseas investment registration、International travel agency registration and other services,Help enterprises expand their presence in international markets。Provide one-stop compliance solutions for enterprises。To learn more,Please contactHong Kong Information Communications Consultant。

Port communication

Port communication